Introduction

Over the last few years Germany’s tech and knowledge-economy freelancers have begun to feel pressure from two related but distinct forces: structural demographic stress on the public pension system, and cyclical economic caution among companies. The net result is a creeping reversal of the earlier freelance boom — a measurable decline in self-employed, no-staff freelancers, a growing willingness by companies to cut external costs (sometimes abruptly), and increasing incentives for contractors to rejoin salaried employment.

Below I lay out the evidence, the mechanisms, and plausible near- and mid-term scenarios for how this mess will evolve.

What the data show (short version)

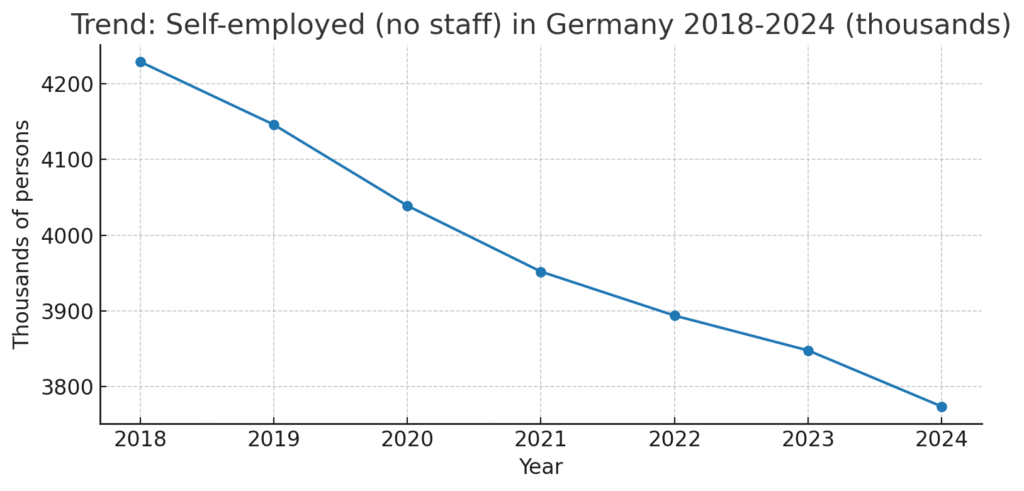

- Official statistics show a gradual decline in the number of self-employed people without staff in Germany from about 4.229 million in 2018 to roughly 3.774 million in 2024 — a persistent downwards trend. (Statistisches Bundesamt)

- Industry surveys and freelance reports confirm the picture in the tech sector: Germany’s freelance market is large (around 1.5 million freelancers reported in 2023 by industry sources), but growth has slowed and some sources show net declines compared with earlier years. (FREELANCERMAP.COM)

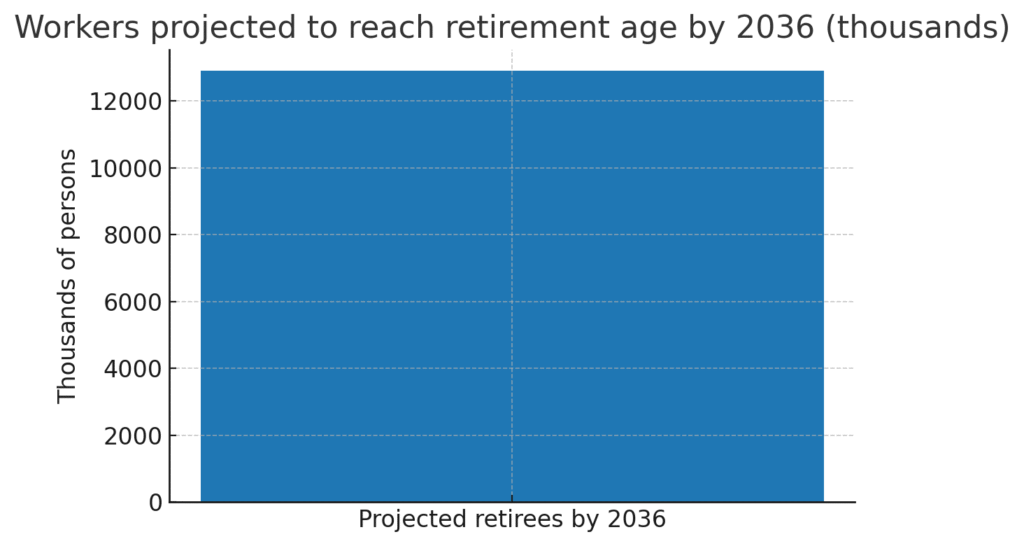

- At the same time demographic projections indicate huge retirement cohorts: estimates put roughly 12.9 million workers reaching retirement age by 2036 — a demographic tidal wave that strains pay-as-you-go pension financing. (DEGIS gGmbH, Bundeswirtschaftsministerium)

Why Germany’s pension logic pushes toward salaried work

Germany’s statutory pension system is fundamentally a pay-as-you-go model: current contributors’ payroll deductions pay current retirees’ pensions. That works well when the ratio of workers to retirees is high — it becomes strained when large cohorts retire. The baby-boomer cohorts (roughly people born in the late 1950s through 1960s) are entering retirement over the next decade and a half, exerting strong pressure on contribution bases and public budgets. Policymakers are already debating big reforms (including raising retirement age and new funding vehicles) because the system’s sustainability is politically sensitive. (EconStor, Der Guardian, Reuters)

Why does that hurt freelancers specifically?

- Contribution visibility and predictability. Salaried employees automatically pay into the statutory pension (and other social insurance) through payroll. For many freelancers the required contribution decisions, voluntary top-ups, and private pension planning introduce administrative and financial uncertainty — especially if future pension rules change.

- Solidarity and political pressure. In an environment where the government publicly emphasizes broadening contribution bases, there is political momentum to bring more people into standard payroll systems (where contributions and benefits are easier to administer). This increases the perceived long-term attractiveness of employee status.

- Risk transfer during demographic stress. If policymakers tighten pension rules (higher contribution rates, longer contribution periods, or reduced replacement ratios), salaried workers preserve automatic coverage and protections that many freelancers must actively purchase — a core reason some freelancers choose “safety” and predictability in employment.

All of these factors make payroll employment more attractive relative to the flexible-but-volatile freelance model — especially for mid-career developers with families, mortgages, or those close to retirement.

Companies’ behaviour: cost fear, uncertainty, and contract pruning

The past few years of macroeconomic uncertainty — rising interest rates, slowing growth in key markets, and high energy costs for German industry — have encouraged firms to reinstall tight cost discipline. That discipline often treats external contractors as discretionary headcount that can be shortened faster than internal staff. Two mechanisms are at work:

- External cost as an easy cut. When managers want to reduce variable costs quickly, terminating or not renewing freelancer contracts is an obvious lever. Several large German firms and multinationals have publicly announced major workforce adjustments and cost programs; contractors and vendors often feel the downstream effect. (Fortune, Reuters)

- Risk aversion and legal framing. Hiring freelancers can carry perceived legal and tax risks in Germany (e.g., concerns about bogus self-employment or future reclassification). Under economic stress, firms prefer the perceived legal safety of salaried hires or of reducing external contractor rosters entirely.

This risk-and-cost calculus has even led some companies to end signed agreements early to avoid ongoing fixed external spend — which increases freelancers’ income volatility and reduces the attractiveness of independence.

The human economic feedback loop

The combination of these forces creates a feedback loop: demographic/policy pressure nudges the political conversation toward more contributors in the formal pension system, firms cut external costs to preserve margins and reduce regulatory exposure, and freelancers who face irregular income or contract cancelations reassess the tradeoff between freedom and security. The result: some freelancers decide to re-enter the labor market as employees — reversing the ‘freelance revolution’ trend seen in other countries.

A survey of European freelancers showed a majority remain satisfied with freelancing, but a non-trivial share are vulnerable to economic swings — and corporate cost cutting brings that vulnerability to the forefront. (Consultancy.eu, Exploding Topics)

Evidence: charts and concrete numbers

I used Destatis long-term series for self-employed (no staff) counts and demographic projections to illustrate the trend:

- Self-employed (no staff, thousands): 2018: 4,229 → 2019: 4,146 → 2020: 4,039 → 2021: 3,952 → 2022: 3,894 → 2023: 3,848 → 2024: 3,774. This is a clear downward slope that matches industry reporting of slowed or negative growth for freelancers in Germany. (Statistisches Bundesamt, FREELANCERMAP.COM)

- Projected workers reaching retirement by 2036: ~12.9 million — that scale explains why pension funding is a central political and fiscal priority. (DEGIS gGmbH)

Outlook — near term (1–2 years)

- Continued pressure and consolidation. Expect more conservative hiring practices in uncertain sectors (automotive, industrials, large tech vendors). Firms will continue to prioritize flexible cost cuts and may prefer temporary layoffs or not renewing contractor agreements rather than creating new payroll roles. (Reuters)

- Policy noise and selective relief. Politicians will debate pension fixes and temporary buffers (sovereign pension vehicles, contribution tweaks). Any announced fixes will likely be targeted and partial; they will reduce headline panic but not fully resolve structural imbalances. (Reuters)

- Freelancer flight to security. Many mid-career contractors with dependents will actively weigh full-time offers, especially in sectors that offer defined-contribution and defined-benefit type stability (public sector, large corporates). This will depress the freelance supply pool for independent gigs, pushing rates for high-end freelancers up, but reducing the overall headcount engaged as independents.

Outlook — mid term (3–7 years)

- Structural shift, not a full reversal. Freelancing won’t vanish — platform work, remote international contracting, and niche consulting will persist and even thrive — but the German domestic freelance mass may shrink from its prior peak as systemic incentives favour payroll coverage. The supply of freelance talent will bifurcate: (a) a smaller cohort of highly paid, specialized independents who can command premium rates and take on international clients, and (b) a larger number of mid-range contractors who prefer stable employment. (FREELANCERMAP.COM, DemandSage)

- Policy responses reshape incentives. If policymakers broaden contribution bases or create hybrid contribution models (e.g., compulsory minimum social contributions for self-employed, or incentives for private retirement top-ups) the market may adapt and stabilize. Conversely, harsher explicitly redistributive measures could further push people into payroll jobs — but also create political backlash. (EconStor, Der Guardian)

- Company strategies evolve. To avoid losing top freelance talent, some companies will innovate contract structures (longer-term retained contracts, flexible employee-consultant hybrid roles, or secondment models). Others will rationalize external supply chains and move to long-term managed services where risk is shifted to vendors.

What freelancers and companies can do now (practical takeaways)

- Freelancers: tighten liquidity buffers, document business independence carefully, diversify client base (internationalize where possible), and consider blended models (part-time payroll + part-time contracting). For older freelancers, plan pension contributions defensively: consider topping up statutory schemes or using private pension vehicles.

- Companies: be deliberate about short-term cuts — abrupt cancellations destroy long-term supplier relationships and raise search/replacement costs. Consider converting top contractors to hybrid roles (fixed portion + variable project hours) to retain knowledge while lowering headline external spend.

Limitations and caveats

- The headline figures aggregate many different kinds of self-employment (creative freelancers, IT consultants, solo traders). The trend I describe is clearest in the “self-employed without staff” series and in tech/IT contracting, but local industry differences remain. (Statistisches Bundesamt, FREELANCERMAP.COM)

- Data sources and industry surveys vary in definitions (who counts as a freelancer versus self-employed), so use the charted series as indicative of direction rather than an exact count.

Summary

Germany faces a demographic squeeze that pushes policymakers toward securing pension contributions and stabilizing payouts. At the same time, economic uncertainty and corporate cost discipline make external contractor spend a convenient short-term target. Together these forces reduce the relative attractiveness of freelance work for many developers and professionals — which helps explain the measurable decline in self-employed (no-staff) counts between 2018 and 2024. The likely outcome is a structural rebalancing rather than a total disappearance of freelancing: expect a thinner, more premium freelance layer, more hybrid employment models, and continued political debate about how to make the pension system sustainable without destroying labour market flexibility.

Sources & further reading

- Destatis — Self-employed without staff / long-term series (table used for year counts). (Statistisches Bundesamt)

- Freelancermap — Freelancer Study 2024 and market blog. (FREELANCERMAP.COM)

- Bundeswirtschaftsministerium — Macroeconomic implications of demographic change. (Bundeswirtschaftsministerium)

- Reuters / Fortune — coverage of corporate layoffs and cost cutting in Germany. (Reuters, Fortune)

- Consultancy.eu — Freelancer sentiment study (Malt). (Consultancy.eu)

- Demographic retirement projection (Degis summary of Destatis projections). (DEGIS gGmbH)

Views: 3